The business travel sector in the Middle East is growing faster than the global average. The market reached $18.1 billion in 2024, while forecasts indicate a 6.1% year-on-year growth into 2025. According to Tumodo’s research, compared to late 2024, the volume of bookings in the region grew by 40%.The broader MENA market is expected to hit $270.8 billion by 2030, propelled by strong infrastructure development and digital innovation. This indicates a higher demand for technologically advanced travel services and expanding business activity within the region. Notably, April and May were the busiest months in the first half of the year – largely due to the return of business travel after Ramadan.

Travel Patterns Across MENA: Major Destinations

Tumodo reports that Saudi Arabia was the most travelled destination in the MENA region, accounting for 20% of all travel, followed by the United Kingdom (15%), France and India (10% each). Finally, trips to Oman amounted to 5% of all travel. These numbers are consistent with global trends reflecting stronger economic ties between MENA countries and European and Asian markets.

Favourite Airlines

In terms of airline preferences, regional players came at the top of the charts. Emirates, Turkish Airlines, and Qatar Airways were the most frequently chosen by business travellers. Tumodo also pointed out that, on average, India remains the most affordable route, while the United Kingdom is the most premium destination – both in terms of airfares and accommodation.

Dubai remains a major hub in the region, with frequent flights to business capitals like Riyadh, London, and Guangzhou. Tumodo has also seen an increase in usage of additional services throughout 2024 and the start of 2025. Specifically, visa support rose by 15%, ground transfers by 11%, and corporate event bookings by 7.25% – all of which signal a growing demand for full-service travel management.

Developments in Corporate Travel: Bleisure, AI Analytics, Sustainability

Internal data from Tumodo shows that in H1 2025, the average trip duration remained at just two days, yet many travellers began incorporating leisure elements into their itineraries, reflecting the ongoing rise of “bleisure” travel. Demand for premium accommodation remained strong, with four- and five-star hotels accounting for over 75% of bookings.

At the same time, Tumodo’s clients reported a 12% decrease in average airfare costs and only a modest 2% increase in booking value as opposed to an average 10% growth across different platforms. This was possible thanks to advanced platform features such as customisable travel policies, approval workflows, and real-time analytics. Additionally, integrated tools for CO2 emissions tracking and eco-friendly route selection are helping businesses align with the UAE’s Environment Vision 2030.

“The impressive 50% year-on-year growth we’ve seen this year signals a shift from recovery to reinvention,” Stan Klyuy, CCO of Tumodo, stated. “With average airfares down by 12% and hotel bookings up only by 2%, we’re helping businesses travel more efficiently by lowering emissions, saving time, and optimising cost using our AI tools and deep data. We’re focused on growing throughout the GCC and Europe in the future, as well as improving the platform with more intricate integrations and predictive capabilities”.

As global business travel rebounds, industry forecasts project corporate travel spending will surpass $1 trillion in 2025, with the Middle East seeing one of the highest growth rates globally at 6.19%. In this ever-changing environment, Tumodo helps the region transition to smoother, more technologically advanced business travel.

About Tumodo

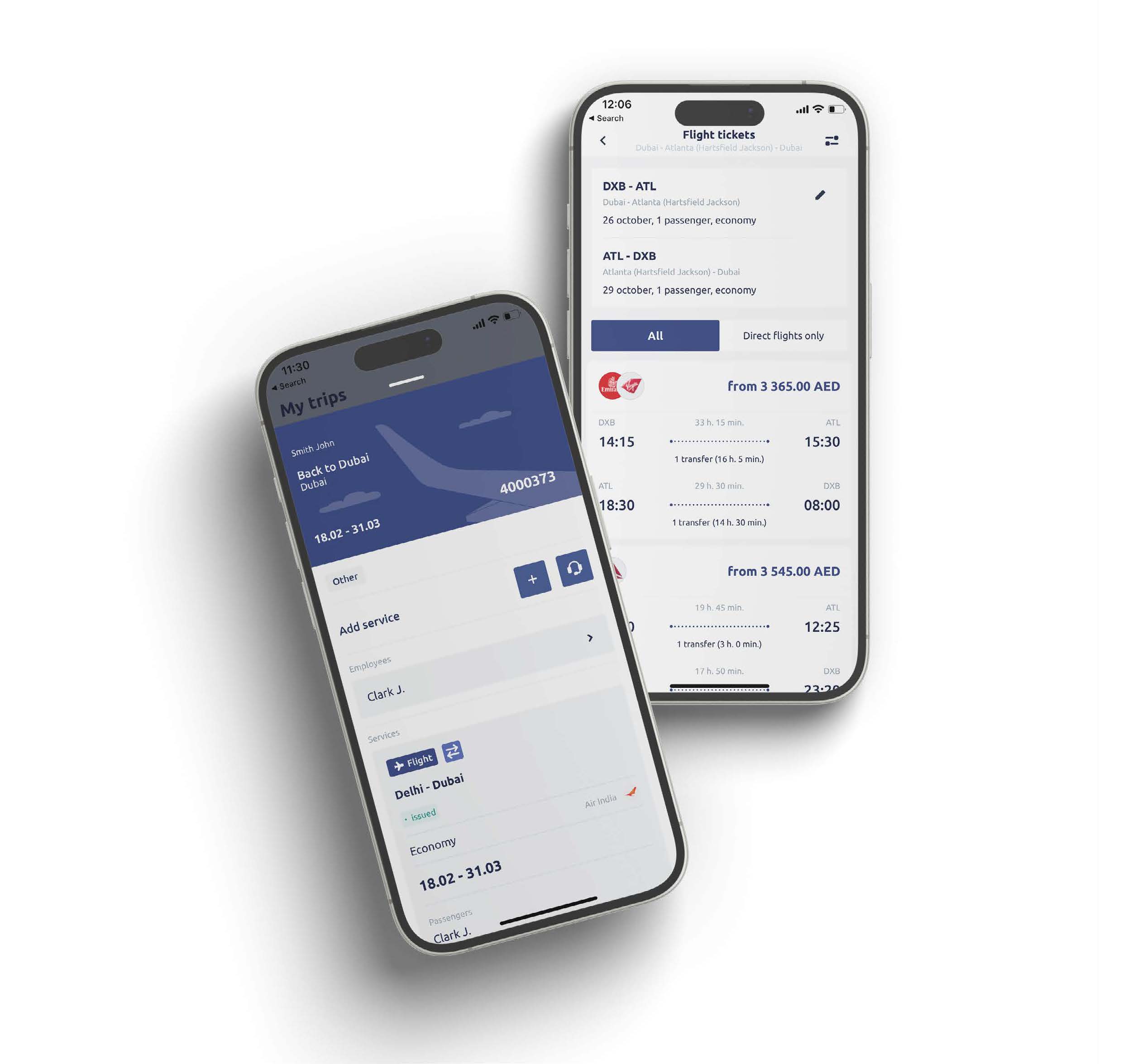

Based in the UAE, Tumodo is an online B2B travel platform that assists businesses in optimising corporate travel. Tumodo offers cutting-edge AI algorithms, a user-friendly interface, and round-the-clock assistance that allow customers to plan and organise their travel in a matter of minutes while saving up to 35% on associated costs.