Clemta, a global digital platform, has launched a new capability for global entrepreneurs to open a U.S. business bank account before obtaining an Employer Identification Number (EIN), a move set to significantly ease entry into the American startup ecosystem.

This update allows Clemta users in the Gulf Region to gain access to banking infrastructure earlier, helping them integrate faster with platforms such as Stripe, Amazon, and PayPal—essential tools for digital commerce.

Helps focus on growing the business

Traditionally, non-U.S. residents face a 4–6 week wait to obtain an EIN from the Internal Revenue Service (IRS) before opening a U.S. business bank account. This delay can stall business operations at a crucial stage.

Clemta’s exclusive partnership with banks and financial institutions remove that bottleneck, allowing founders to establish financial operations while the EIN process is underway.

“Our goal is to remove friction for entrepreneurs from the first day,” said İlayda Şencan, CEO of Clemta. “For many entrepreneurs – especially those in the Gulf region – this one delay can hold up everything from product launches to investor conversations. This new feature helps them move quickly and focus on growing their business rather than navigating paperwork.”

US continues to be powerhouse in funding startups

The update comes amid historic growth in the U.S. startup landscape. According to the Commerce Institute, a record-breaking 5.49 million new businesses were started in the U.S. in 2023, an 8.1% increase from the previous year. This surge continues a multi-year trend fueled by post-pandemic entrepreneurship and the rapid expansion of e-commerce.

At the same time, the U.S. venture capital market is showing no signs of slowing. Statista forecasts that capital raised in the U.S. venture capital market will reach US$140.46 billion in 2025, making it the largest globally.

Clemta positions itself as an end-to-end platform that supports entrepreneurs throughout the business lifecycle – from company formation and structuring to tax compliance, accounting, and financial reporting. All services are provided remotely, eliminating the need for physical presence in the United States.

Removes the administrative hassle for founders

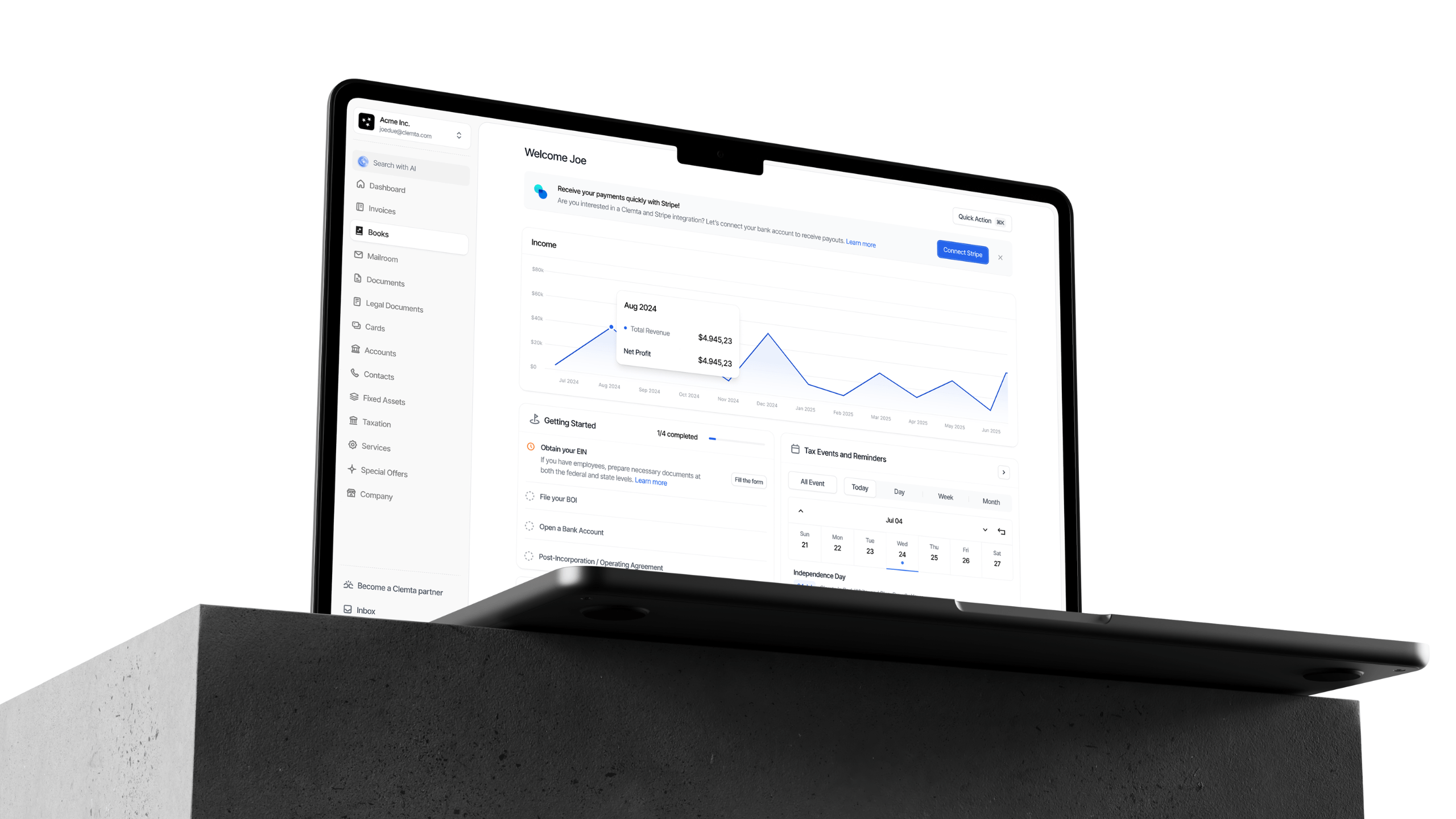

In addition to its company formation services, Clemta offers a comprehensive business management dashboard that supports founders after incorporation. The dashboard automates recurring administrative tasks with AI, offering visibility and control over compliance, documents, deadlines, and filings in one place.

“Our users are only focused to build technologies, products, and services that require their full attention,” added Şencan. “By removing administrative delays and bundling business management into one platform, Clemta gives founders time back to do what they do best.”

The feature is available exclusively to Clemta users and is expected to benefit entrepreneurs in the UAE, Saudi Arabia, Qatar, and over 150 other countries where Clemta’s services are already in use.