The Julius Baer Global Wealth and Lifestyle Report 2024 is being published against a complex global background. As this year’s results show, the impact of the global pandemic has settled into a ‘new normal’. However, inflation, rising living costs, and increased geopolitical tensions continue to impact prices and priorities globally.

In 2024, price rises have slowed to 4% on average in USD terms, compared to 6% in 2023. Prices this year grew faster for goods than services, with goods up 5% on average and services up 4%, both in USD terms. Although cities continue to become more expensive, we have seen a normalisation of inflation rates over the past 12 months.

The city ranking is based on the Julius Baer Lifestyle Index, which analyses the cost of a basket of goods and services representative of ‘living well’ in 25 cities around the world.

Regional findings

While Singapore (1st, unchanged) and Hong Kong (2nd, up from 3rd) still dominate the podium, the Asia Pacific (APAC) region drops down the regional ranking to 2nd place for the first time, due to lower rankings for cities like Tokyo, and a very strong return to prominence for EMEA. Last year, EMEA was the cheapest region to live well. This year, driven by London taking the 3rd spot (up from 4th) and every single European city moving up the ranking, as well as strong exchange rates vs. the US dollar (Euro +4%, Swiss franc +8%), EMEA is the most expensive region to live well. Within the EMEA, Dubai is the 6th most expensive city and 12th globally (down from 7th) in Lifestyle index owing to inflation and currency fluctuations. Although, the Americas fall to last place, both New York and São Paulo remain in the top ten.

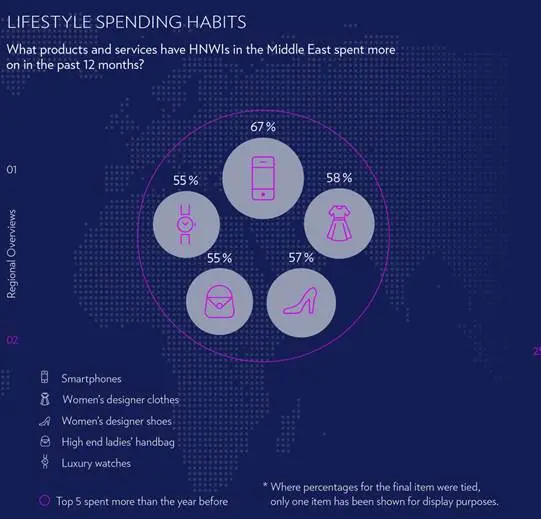

In the Middle East, spending was concentrated on luxury goods such as clothing and watches, but most significant of all was the demand for luxury residential properties. Middle East’s HNWIs focus on premium products – such as designer clothing, jewellery, and luxury watches – and real estate, while Europe and APAC focus on hospitality (five-star hotels, top restaurants) and spending in the Americas seems to be spread across all categories.

All regions saw an increase in spending by HNWIs (high-net-worth-individuals) on travel and hospitality in the past year, with the Middle East and APAC showing the highest growth. The Middle East has witnessed a significant increase in business (65%) and leisure travel (67%).

Although there has been some financial turmoil in the past 12 months, HNWIs are still willing to take risks to realise higher returns. Supported by their own financial expertise and increased asset values, HNWIs from APAC, the Middle East and Latin America have increased the risk level of their investments, although Europe and North America remain more conservative in their outlooks.

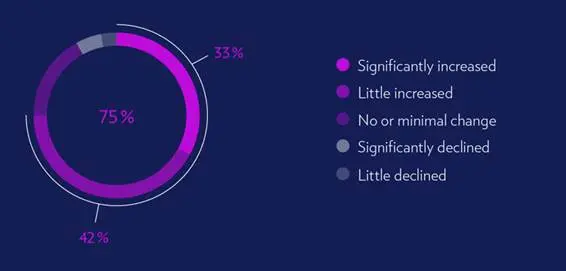

As in previous years, and not surprisingly, the primary financial goal among our respondents is wealth creation and increasing assets. In all regions, HNWIs invested more in the past 12 months than in the year before, with the Middle East leading the charge with 72% investing more and 68% of those in APAC investing more. Regional investment levels seem to mirror regional risk levels here too, with Europe and North America being the most conservative once again.

Dubai: the wealthiest city in the Middle East

Dubai now holds the 12th spot in the Global Wealth and Lifestyle Report and is the 6th most expensive city in EMEA. The emirate has long been one of the most attractive economic hubs and a symbol of opulence in the Middle East region. Although the impact of the global pandemic has now settled into a ‘new normal’, inflation, rising living costs, and increased geopolitical tensions have not had as much of an impact on Dubai as on other markets, which have contributed even more to its appeal for wealthy residents.

A key advantage is that the UAE, situated at the crossroads of the East and the West, boasts some of the busiest airports and prominent ports. The unique geographical advantage of Dubai attracts businesses from all over, making it an ideal market for global expansion. The report reflects that spending on business (65%) and leisure (67%) travel have increased significantly over the past 12 months in the Middle East. Its strategic location has also made it attractive for investors looking to access lucrative markets across multiple continents.

The report highlights that the real estate sector accounts for 8.9% of the economy and is showing impressive dynamism. According to the index and survey data, real estate is a key asset in the Middle East, with prices in Dubai up 16% in US dollar terms. Property in Dubai is, simply put, ‘hot property’. With the world’s most active USD 10 million housing market in 2023, according to Knight Frank, both global and local demand is sky high. The region’s wealthy are spending the highest currently on luxury residential properties compared to any other region, amid strong economic growth and world-class infrastructure.

Even though, the residential market has sustained an upward trajectory in prices, residential property is relatively affordable compared to many cities in the region. Sophisticated and smart investors are moving to Dubai to buy luxury and branded real estate given the competitive advantage the city offers compared to global and regional peers. This growing trend will keep Dubai on the global investors radar. More than half of wealthy Middle Easterners in our survey said they had spent more on residential property in the past 12 months, and planned spending is equally high, with 58 per cent saying they will spend more in the coming 12 months. No other region comes even close to this.

Chart 1: LIFESTYLE SPENDING INTENTIONS:

What products and services have HNWIs in the Middle East spent more on in the past 12 months?

The report notes that within EMEA, Dubai is the most expensive city for men’s suits and ladies’ handbags. Higher than average spending on these discretionary items reflects that Dubai continues to represent a big opportunity for luxury brands where affluent customers have an increasing appetite for luxury goods. The steep prices are not deterring buyers, though with 65% and 52% of those surveyed intend to spend more in the coming year on suits and handbags respectively.

With no income tax, capital gains, or inheritance taxes, Dubai is emerging as a preferred wealth hub for many entrepreneurs and rich families as they look to take advantage of favorable policies and expand their businesses. Interestingly, the index reveals that ultra-rich in Dubai and across the Middle East are bullish in their investment outlook with primary goals of wealth creation, increasing assets, and boosting their portfolios.

Chart 2: ASSETS

How has the total value of Middle East’s HNWI’s assets changed in the past 12 months?

The city continues to emerge as a new financial powerhouse as prominent global hedge funds, asset managers, fintech companies, and family offices are establishing regional offices to solidify Dubai’s status as a premier destination for the global elite.

Fahd Abdullah, Executive Director, Investment Advisory, Julius Baer (Middle East) Ltd., said: “Gulf Cooperation Council (GCC) states remain robust despite the conflict in the region, as it is expected to remain relatively contained. GDP forecasts have been revised downwards on account of uncertainty around the impact on activity. Growth is nevertheless anticipated to pick up in 2025. Non-oil activities continue to be the key focus in 2024 as production cuts hamper oil-GDP. In the UAE, for instance, Abu Dhabi’s non-oil economy grew 9.1 percent in 2023, bringing the sector’s total GDP contribution over 53 per cent.

Rebounding dramatically following Covid-19, growth in the tourism sector especially for Dubai, was strong, seeing an 11 per cent increase year-on-year, with overnight visitors on track to exceed 20 million visitors in 2024, contributing about 12 per cent to overall GDP. Dubai is also continuing to position itself as a new capital for global finance acting as a bridge between east and west with a traditional banking model as well as a digitally powered economy.

Transport and storage represent the other large piece of the non-oil GDP component for the UAE showing exponential growth. In summary, the Middle East led by the GCC countries should continue to enjoy surpluses on the fiscal and current accounts in the interim. Inflation, albeit higher than before, is still among the lowest in the emerging markets.”

Lifestyle survey findings

The Lifestyle Survey delves into the lives and consumption trends of HNWIs in 15 countries in Europe, APAC, the Middle East, Latin America, and North America. The survey also examines shifts in consumption patterns and interrogates the reasons behind these changes. In doing so, it paints a broader picture and provides insights and data which substantially augment our Lifestyle Index.

As we noted in last year’s Global Wealth and Lifestyle Report, the trend for health as the new wealth is continuing to gain momentum. Health spending featured in the top five for all regions when it came to spending intentions for the next 12 months and it remains a key focus globally. HNWIs, particularly in APAC, will focus their investments on healthcare.

Supported by their own financial expertise and increased asset values, HNWIs from APAC, the Middle East and Latin America have increased the risk level of their investments, while conservatism and fragility prevails in Europe and North America.

While personal enjoyment remains a key pursuit, sustainability plays a greater role in investment strategies in 2024 for almost all HNWIs in APAC, the Middle East, and Latin America. More responsible investments have been made in these three regions, with the majority of HNWIs having reviewed their portfolio to understand the ESG impact of their investments, with a significant higher ESG orientation than in Europe and North America. However, what is true for investments is not true for goods, as sustainability still plays a minor role in actual purchasing habits.

While HNWIs still want to indulge themselves, they are also seeking to empower themselves by prioritising health, aesthetics, and the acquisition of cutting-edge technology. They want to take long-term bets by acquiring property, particularly HNWIs in the Middle East. With demand still outpacing ethics, the challenge will be to encourage HNWIs to fully integrate sustainability into their life and investment decisions, in all markets.

To download the Julius Baer Global Wealth and Lifestyle Report 2024, please visit: www.juliusbaer.com/GWLR