Tell us your name and what you do

My name is Marilyn Pinto. I’m the Founder of KFI GLOBAL, an education company that specializes in getting teens & young adults make smarter money decisions.

Over the last 5 years over 5000 students have gone through our life-changing programs and better equipped to handle money smartly and responsibly.

We’ve partnered with some of the most respected organizations in the region like Dubai Islamic Bank, Emirates NBD, National Bond, TECOM Group etc, to bring this critical education to more teens across the country.

Tell us your background

Together with my husband, I run an advertising & publishing company that we started nearly a decade ago.

I’ve graduated in Biochemistry, got a post graduate degree in Finance & Marketing and an MBA as well.

None of all those years of education taught me anything about managing money.

What is your specialist skill?

I can simplify complex concepts and teach them to teenagers in a way that effective and memorable.

That’s where the Rebel Educator comes in…

I want the teens we teach to be intrinsically motivated — not by some grade they get on an exam but because they see the value and benefit in the learning.

I want them to be deeply engaged — not compliant, because they enjoy and look forward to the interaction.

I want them to be intensely curious because that’s their nature.

It’s our responsibility as educators to kindle this deep engagement and intense curiosity.

It’s our responsibility as educators to ensure that they feel profoundly empowered by what they’re learning.

It’s our responsibility as educators to inspire them to keep learning long after it isn’t required by the education system.

Because then, and only then, can they know what it truly means to learn.

But it’s also more than that.

We need to dismantle the framework of fear and coercion the education system thrives on.

We need our teens to stop seeing themselves through the lens of SAT scores, aptitude tests and Instagram filters; and realize that they are each, unique and incomparable.

We need to stop trying to get them to fit into whatever metaphorical box is currently mandated by the powers that be; and actively encourage them to own the wonderful traits that make them stand out.

We need to understand that standardized tests cannot measure empathy, compassion, and kindness — the main qualities of an evolved human being.

We should take time to see them as individual students, not just a class.

We should take time to build trusting relationships with them, keeping in mind what James Comer said, “No significant learning takes place without a significant relationship”.

We should inspire them to a global consciousness — not just a nationalistic one, a sense of justice — not just lawfulness, and a respect for life…. all life.

That’s what a rebel educator does…it’s what I strive every day to do.

Tell us about your book ‘Smarter, Richer, Braver’.

The book is aimed at parents of teenagers. It breaks down the issue of financial education – it gives the reader a deep understanding of the problem, because I believe it’s important to understand the problem fully before we ever attempt to solve it.

It talks about the obstacles involved and gets parents to see the issue of financial education in a very different, more holistic light – one that then sets the stage for empowering their teens with this crucial life skill.

I think this excerpt from the introduction will answer shed more light on this question:

If you’re looking for an inspirational, feel-good book about parenting, put this down quickly because this isn’t it.

If you’re looking for a book that will give you three hot tips that will transform your teens into financial gurus, then again look away as this isn’t it.

However, if you’re looking for a book that has some hard truths and valuable insights about why our teens are so clueless about money, how important this skill is, the ways it will transform their thinking and lives, what to look for in a good financial education programme, the common mistakes to avoid and a blueprint of how to financially empower them while keeping your sanity, then this is exactly the book for you.

This advice isn’t from an academic’s desk or an investment banker’s multiple monitors, it is battle-tested on the treacherous terrain of teen classrooms and family dining tables.

What inspired you to write this book?

My kids and the thousands of kids we’ve taught through KFI GLOABAL. I’ve seen first-hand how having this skill can make a difference in their lives, how it can help them step-up, stand out and live a life on their own terms.

I’d like youngsters everywhere to be part of Generation Wealth:

A generation that aims to be financially secure.

A generation that’s taking charge of their future.

A generation that wants to do better, not just for themselves but for humanity as a whole.

Being financially empowered enables them to do that. And that’s my promise… a generation that’s

SMARTER RICHER BRAVER

Because that’s exactly what our world needs.

Yet, for the most part, kids aren’t getting this crucial education and it’s up to us as parents to change things. We can’t afford to wait for anyone else to take a stand on this issue, because no one else has as much to lose (except our kids).

Helping parents to understand the issue, what’s at stake if we don’t act and continue to keep our ‘eyes wide shut’, how this skill can turbocharge their teens future – that’s what this book does.

I’m hoping it inspires them to take definitive steps to educate their kids on this important topic.

How does it help develop financial literacy?

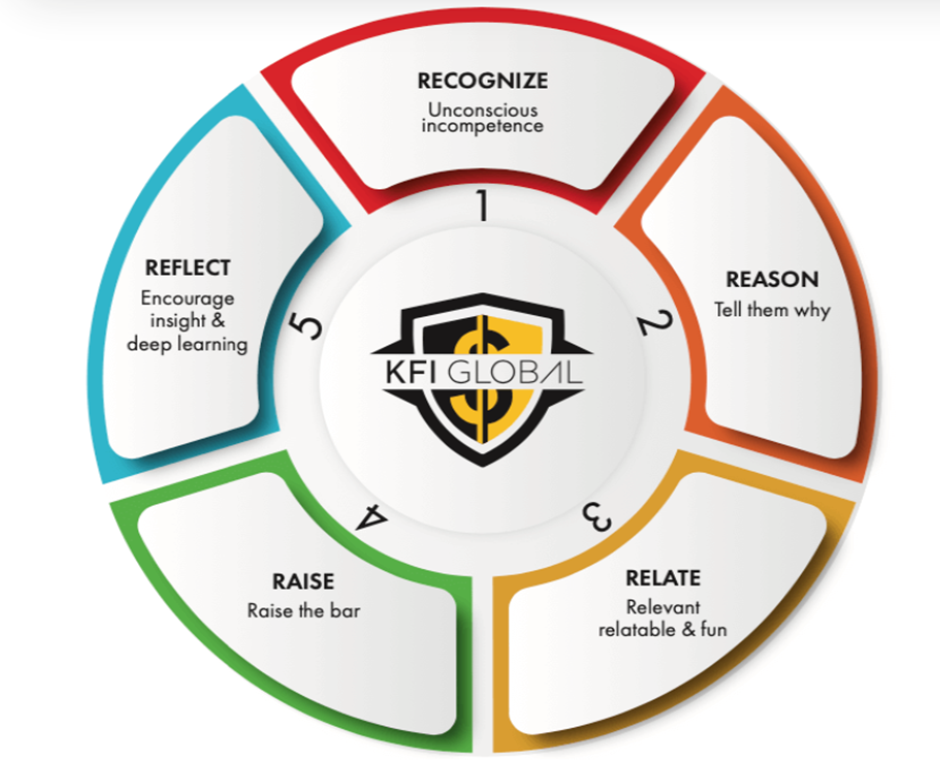

By first, making parents aware of the gap in knowledge, one that’s not being filled in by anyone. Being acutely aware of the financial illiteracy problem, understanding the systemic issues involved, recognizing the obstacles that might thwart the best-meaning efforts and finally providing a blueprint to teaching teens about money with our 5 step methodology. That’s how this book helps further the cause of financial literacy.

It’s important to understand that the issue isn’t a lack of resources, the internet is teeming with books and videos and all sorts of personal finance content.

Yet financial literacy scores in the US are actually lower than they were a decade ago. And the situation isn’t much better elsewhere. Gen Z is doing worse on these scores than Gen X or Y, according to a new report by the TIAA institute and the Global Financial Literacy Excellence Center (GFLEC) at the George Washington University.

Financial education for teenagers is an extremely emotive topic.

Yet, while everyone agrees it is a critical lifeskill that teens must be taught, there hasn’t been much (or any) thought put into what is the best way to do it.

That’s the only way one can explain the narrow focus, abysmally dry content and ineffective delivery of most financial education programs targeted at teens.

It’s like we are willing them to fall asleep or curse their luck for being stuck in yet another class that they find absolutely no joy in.

And make no mistake, for any learning to be effective, there needs to be joy.

So, we’ve looked long and hard into the problems surrounding this issue, done tons of research, and though a hundred iterations have crystallized our methodology:

A 5-step blueprint that revolutionizes the way financial education is taught to teens.

Each of these steps is crucial; not just for the effectiveness and impact of the program but also, equally importantly, to ensure a thoroughly enjoyable learning process for the students.

Can you share a case study of the method in the book achieving success?

Aryaan had always been fascinated by the topic of money, especially since he started a small online business. He had tried to learn more about money by watching videos on YouTube, but he soon realised that the knowledge he gained from these was limited. He could see a credibility issue as they all inevitably tried to sell him some product or another. He found that he was reacting to buying messages, to influencer-led marketing and to the usual sales tactics.

Since completing the program, Aryaan has become more mindful and conscious of how and what he spends his money on. He notices the difference when he compares himself to his friends and classmates who seem to have no such compunction and just spend mindlessly on things they don’t need. At home too, he takes a much more active role in financial decisions. He feels that learning about money has made such a difference to his life.

Aryaan is now confident about his future and believes that his money skills give him a huge advantage over other kids his age. He has easily identified and steered clear of scams and is mindful of not making impulse purchases.

He wants to carve out a career in music and is already making money by creating music that he sells. He has invested in learning more and is better equipped for what he sees as something he’s interested in making a career of.

How can readers find out more about your book?

Our website is www.kfi.global and our social media handles across all platforms is @kfigkobaltribe

I am most active on linkedin: https://www.linkedin.com/in/marilyn-lydia-pinto/

The book is available on Amazon and we will be running a kindle promotion at a 96% discount on June 21, so mark that date if you’d like to get the kindle version of the book.